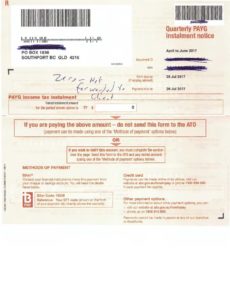

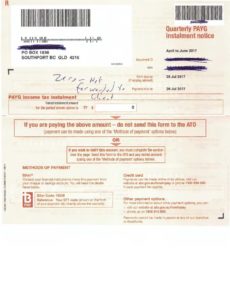

I am not really sure why the Tax Office sends out notices that client owe nothing. A waste of resources and time!

Why

I am not really sure why the Tax Office sends out notices that client owe nothing. A waste of resources and time!

Why

The $20,000 small business immediate tax write-off for asset purchases ends on 30 June 2017. If you are in small business, it makes sense to make any large asset purchases before 30 June.

Wishing you a very Merry Christmas and happiness and health for 2017.

Stephen Kofod

Kofod & Co

This is the third day that the Tax Office’s computers are down! A billion dollar computer system that can’t do a backup! Perhaps they used the same computer “gurus” as they did for the Census?

Without the Tax Office Computers being up I can’t finish and lodge Tax Returns!

We have moved to a new office!

The address is: Level 1, 115 Scarborough Street SOUTHPORT QLD 4215

The new office phone number is: (07) 5641 4271

Only 18 Days to the new Financial Year!!

2016 Flyer for Blog

It is really common sense to keeping your accounting fees down.

Be organised and responsive

Put simply, negative gearing is losing money on a investment, usually real estate. The loss comes about when the costs of owning the property exceeds the rent received. The major cost is usually interest.

Why would somebody want to lose money? Even if the loss is tax deductible.

The answer is that the investor is hopeful of making a capital gain on the sale of the property. The gain on the sale adds to your wealth, the losses incurred along the way don’t.

This is the key to making negative gearing work. Don’t concentrate on the losses, concentrate on making gains by buying quality investments.

Another example of a politician not understanding business, or even reality.

How can a business turning over $40,000 per week not afford a $6,000 toaster?